1120 Irs Schedule C 2024 – Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to . In other words, someone with $100,000 in taxable income in 2024 would fall into the 22% bracket, but would owe a tax bill far below $22,000. Get your tax years straight Tax years can get confusing. .

1120 Irs Schedule C 2024

Source : carta.com

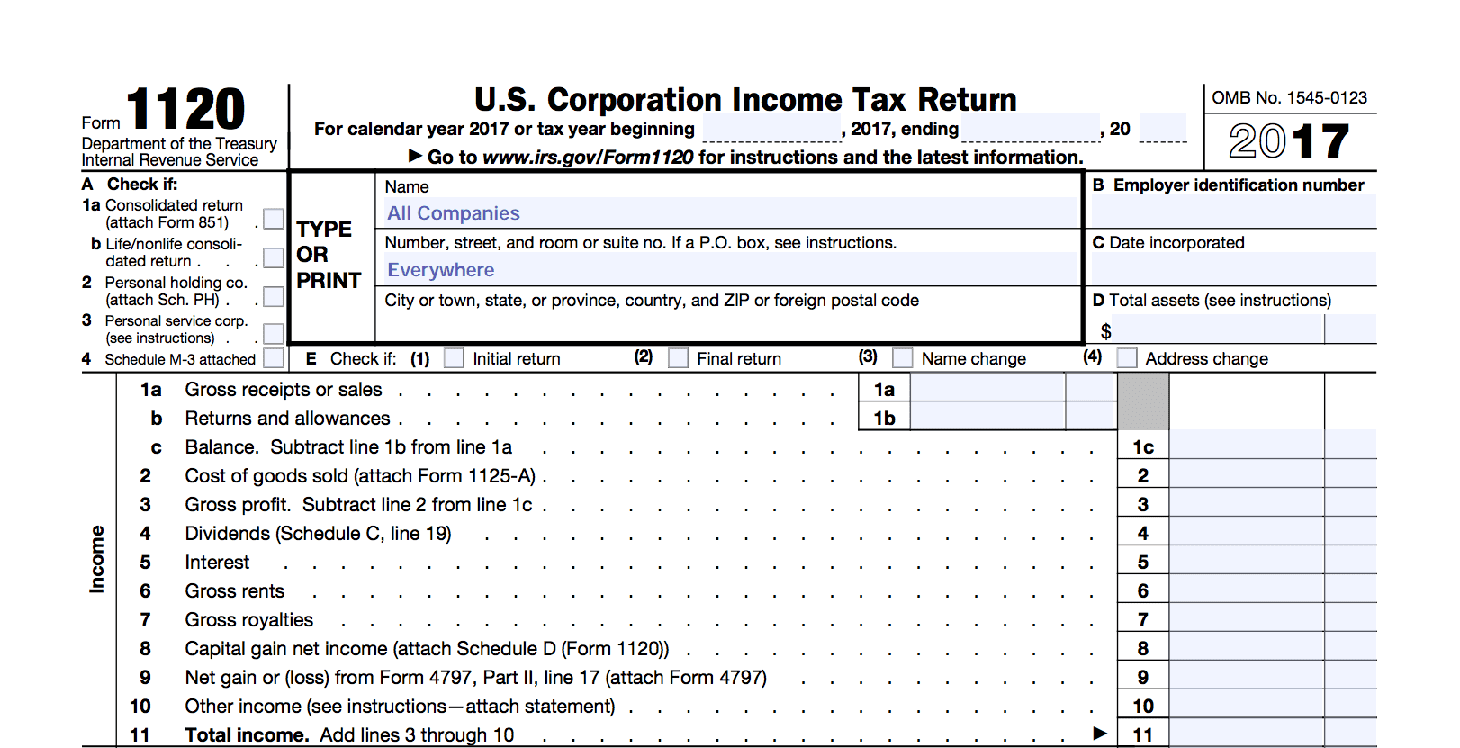

IRS Form 1120

Source : kruzeconsulting.com

Money Market Las Vegas | Las Vegas NV

Source : www.facebook.com

What Is Form 990 Schedule C? YouTube

Source : www.youtube.com

A & J Accounting & Associates

Source : www.facebook.com

Pranjal Shah on LinkedIn: #uscpa #ustaxation #ustreasury #irs

Source : www.linkedin.com

Amazon.com: TurboTax Business 2014 Federal + Fed Efile, Corp

Source : www.amazon.com

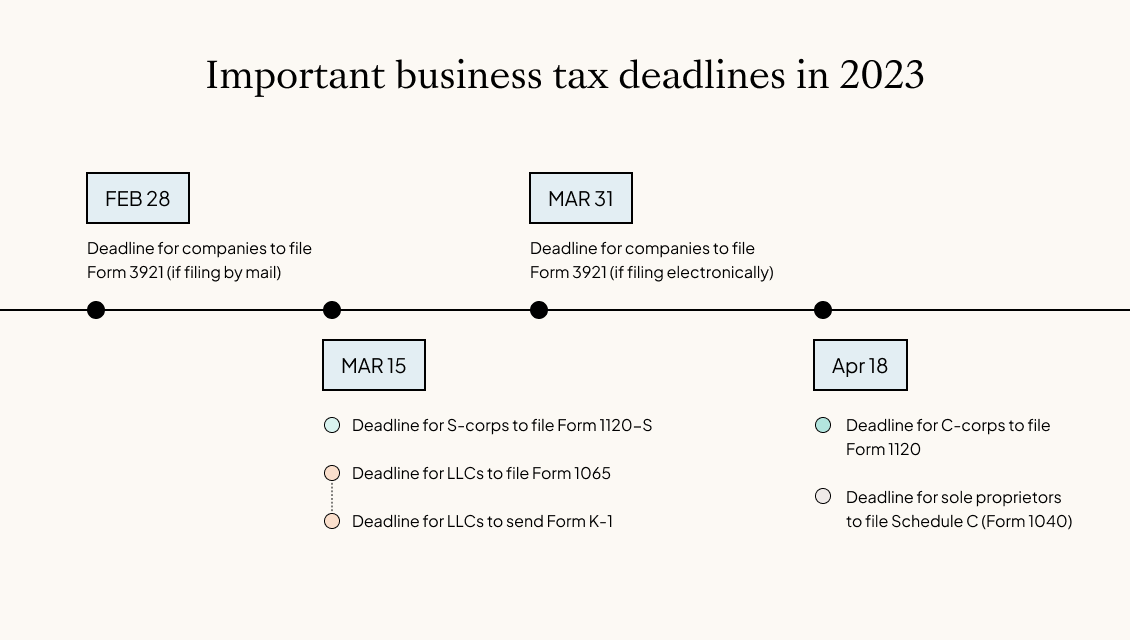

Business tax deadlines 2023: Corporations and LLCs | Carta

Source : carta.com

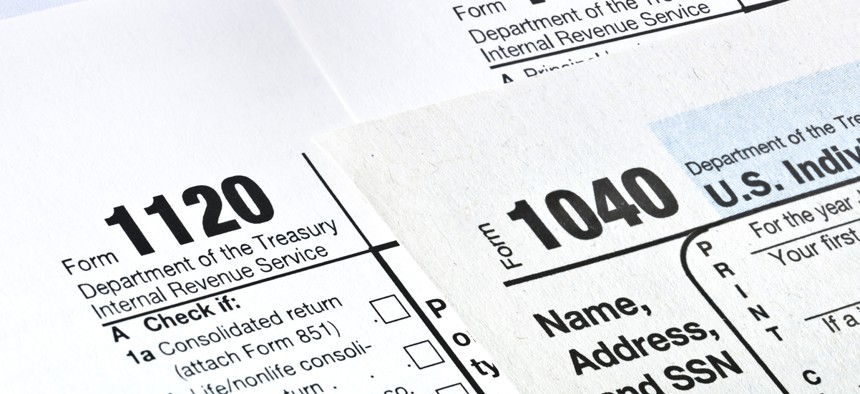

The Most Common IRS Tax Forms You’re Likely to Come Across When

Source : www.govexec.com

Executive Master of Accounting (EMAC) Tax Concentration | FAU Business

Source : business.fau.edu

1120 Irs Schedule C 2024 Business tax deadlines 2024: Corporations and LLCs | Carta: The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual . That could provide a break to some taxpayers on their taxes in 2024. The tax agency on Thursday said it’s adjusting the tax brackets upwards by 5.4%, relying on a formula based on the consumer .

More Stories

2024 2024 Louisville University Basketball Schedule Wiki

Kaiser High School Varsity Wrestling Schedule For 2024 2024

Rchs Schedule November 2024